ESG Assessment

ESG Sustainable Investing

Environmental, Social & Governance Risk Management.

Improve your ESG performance and direct the narrative. Speak to us now

Shared Responsibility

Integrating ESG risk into a risk management framework for a more positive future

Step One.

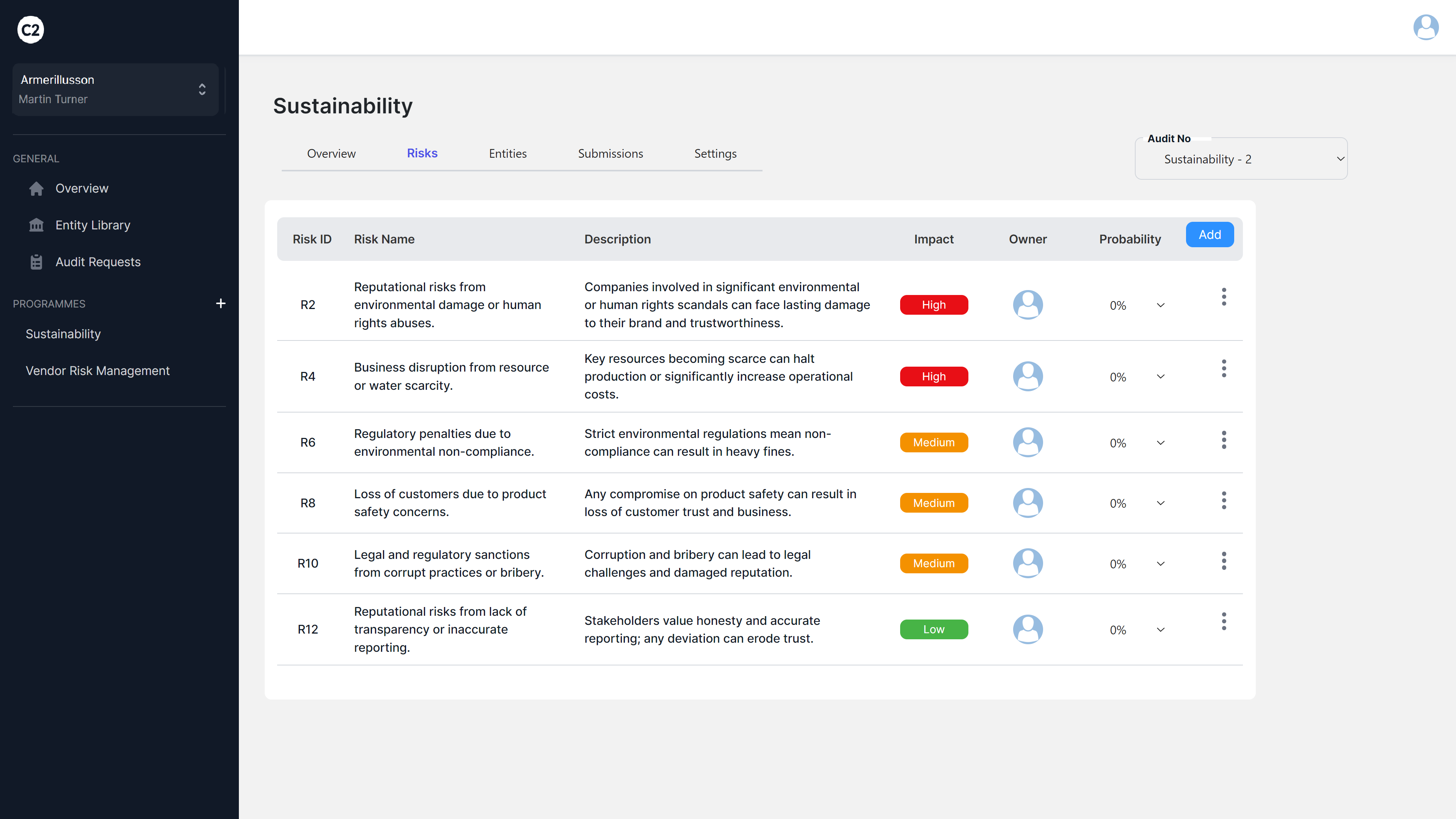

Define Risk

Create your Risk Appetite statement and assign a guiding score to streamline decision-making. Incorporate ISO 14001:2015 standards to accurately define environmental risks and set compliant goals

Sustainable Development Goals

Set SMART SDG Goals you want to achieve and compare these with other areas of the risk mitigation solution. All of which help show businesses are serious about measuring, managing and communicating their SDG activities.

Step Two.

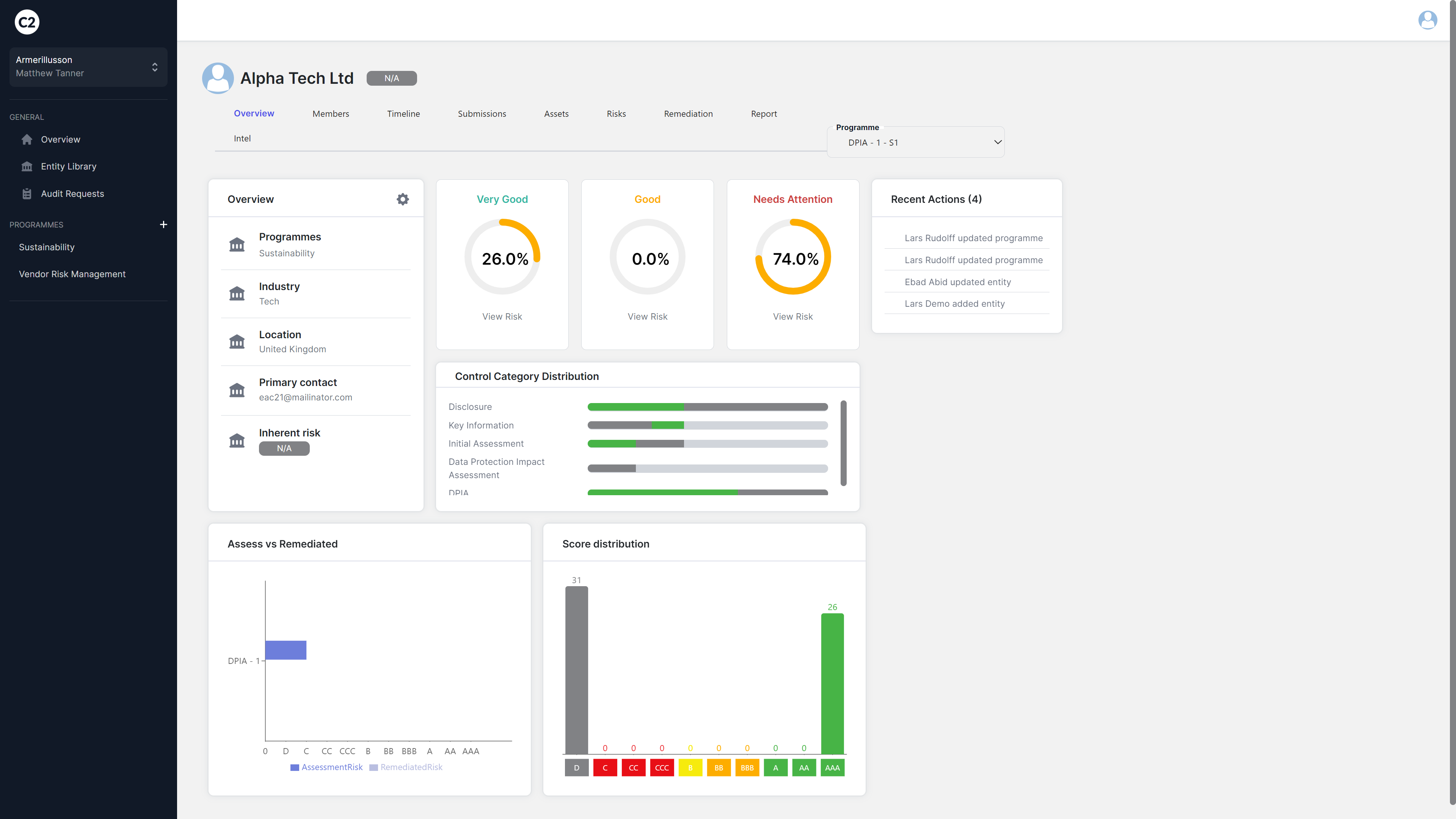

Calculate your Inherent Risk

Understand which attributes of each ESG factor poses the highest risk and on the contrary adds potential value to your Investment. The outcome of this can be used to guide the level and terms of investment for underwriters. It also helps highlight to shareholders what risks need controls to make an intolerable risk feasible or what controls can make an investment more lucrative.

Step Three.

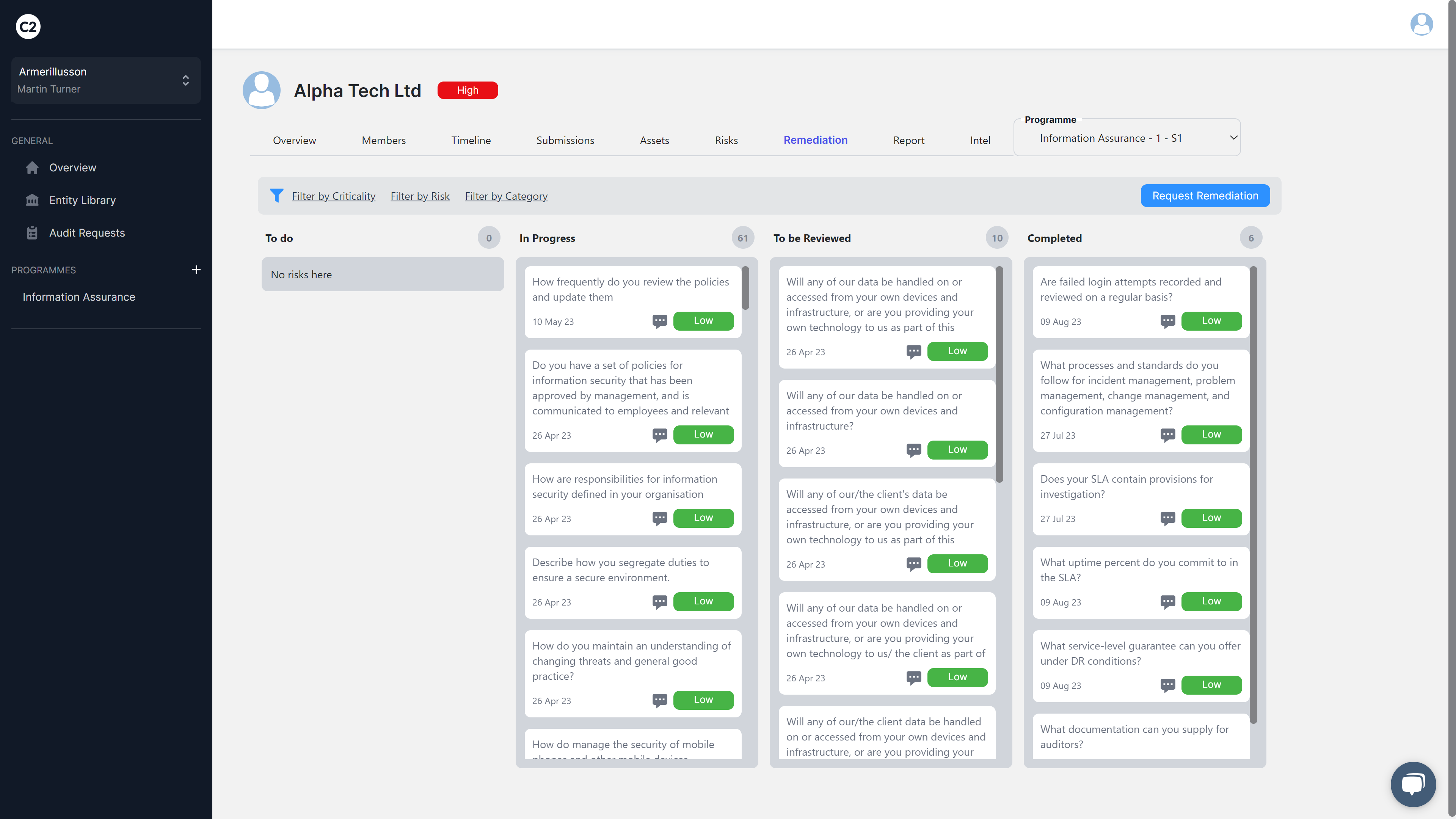

Identify & Analyse Controls

Identify Controls on highlighted Risks and Key Value Drivers. Request Documentation such policies, procedures, compliance registers

Analyse how well a Control is implemented, having a control written on paper doesn’t really help!

Remediate by Assigning New Controls for Each ESG Factor to drive additional value and reduce the overall residual Risk

Step Four.

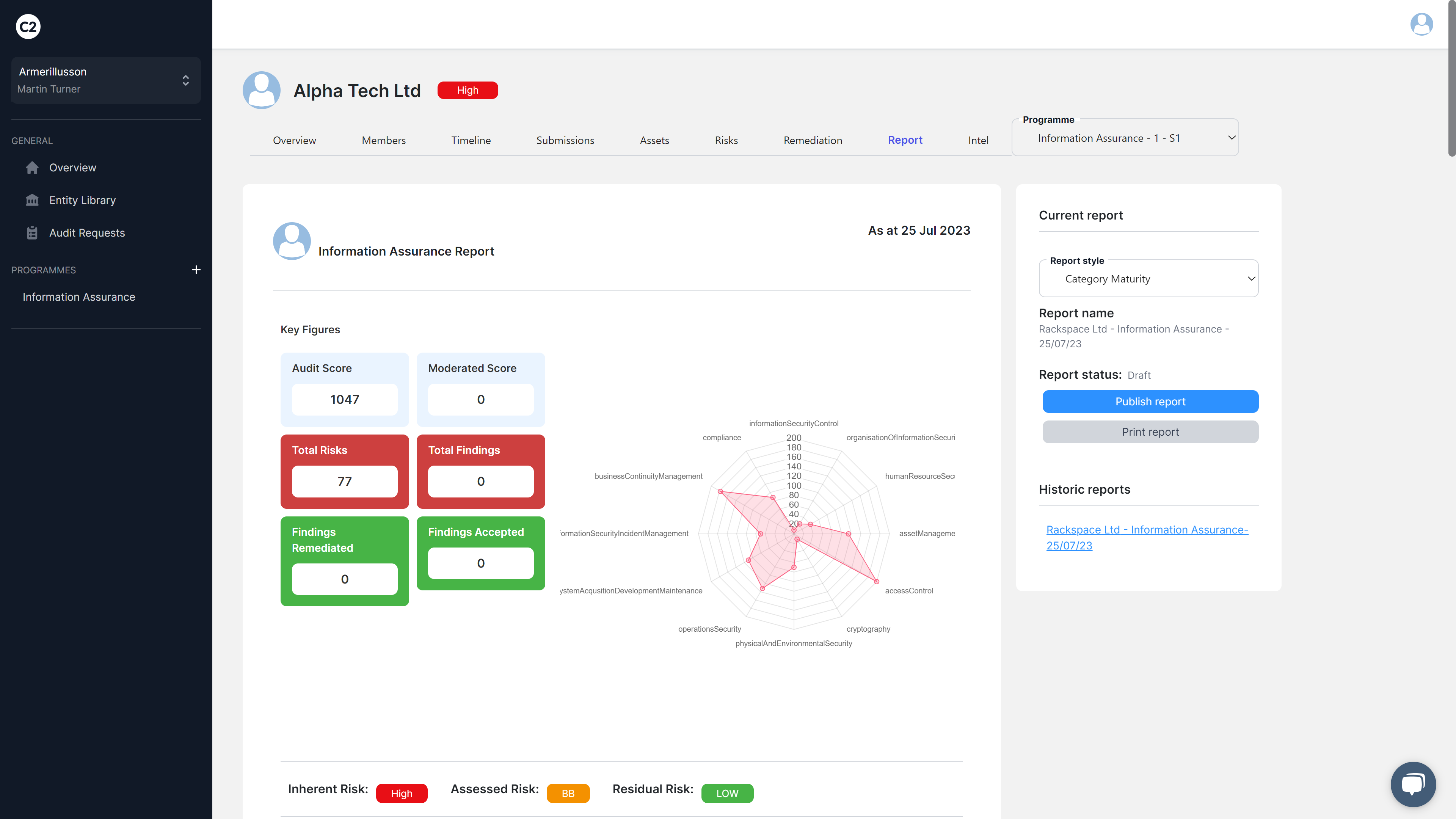

Calculate the Residual Risk & Value

Assess your Residual Value and Residual Risk against your Risk Appetite and Sustainable Development Goals you set out in the first step

Add in contextual information on what that Residual Value or Risk means, is it a decreasing or developing factor

Set Re-Assessment reminders and invite your team for secondary views

Dont hesitate, join our growing global partner community today.

Managed ESG Service

Independent peer reviews & benchmarking

Our Environmental, Social & Governance risk management service provides an automated application of ESG measurement practices to the unlisted equities market. Key benefits of our ESG risk management service include ease and accuracy in ESG reporting and disclosures. Our platform, aligned with ISO 14001:2015 Environmental Management System (EMS) standards, ensures comprehensive management of environmental impacts. It offers a lower cost of ownership compared to hiring a similarly sized and experienced team, requires minimal training and setup, and allows for the implementation of a structured, well-refined process. Additionally, it is a completely scalable solution with forecastable pricing.

The Purpose of ESG

ESG (Environmental, Social & Governance) is a risk management framework which measures the sustainability and societal impact of a company and helps determine future financial performance.

Growing Importance

Increased environmental consciousness and social change has compelled investors to think more carefully about the potential environmental and societal harms associated with a company's activities.

Opportunities to Gain

Beneficiaries and clients are calling for greater transparency about how and where their money is invested, and investors have a responsibility to understand and enforce more positive and impactful policy.

Redefined Approach

There is growing recognition that the financial sector has a pivotal role to play in meeting global targets, such as those laid out in the United Nations Sustainable Development Goals.

Simplify supplier assessments and enhance risk management with C2’s ProAssure Services

Become a C2 customer today.

Complete the demo request form and a member of our team will be in contact with you.